For some lenders, it can be one payment, but usually a default occurs after a specified number of months. Keep in mind that the threshold when missed payments becomes a default will vary by lender, but your lender will explain their terms in their contract. This can include just one missed payment or several, and can apply to anything from your mortgage to your credit card bill.Ī missed payment becomes a default once your lender has decided to close your account. If you have paid within the time given, no further action will be taken – but you should avoid missing further payments or you will get another letter.Ī default is any missed payment on any money that you have borrowed. These notices can only be sent on credit covered by the Consumer Credit Act, such as credit cards, personal loans and mobile phone contracts.

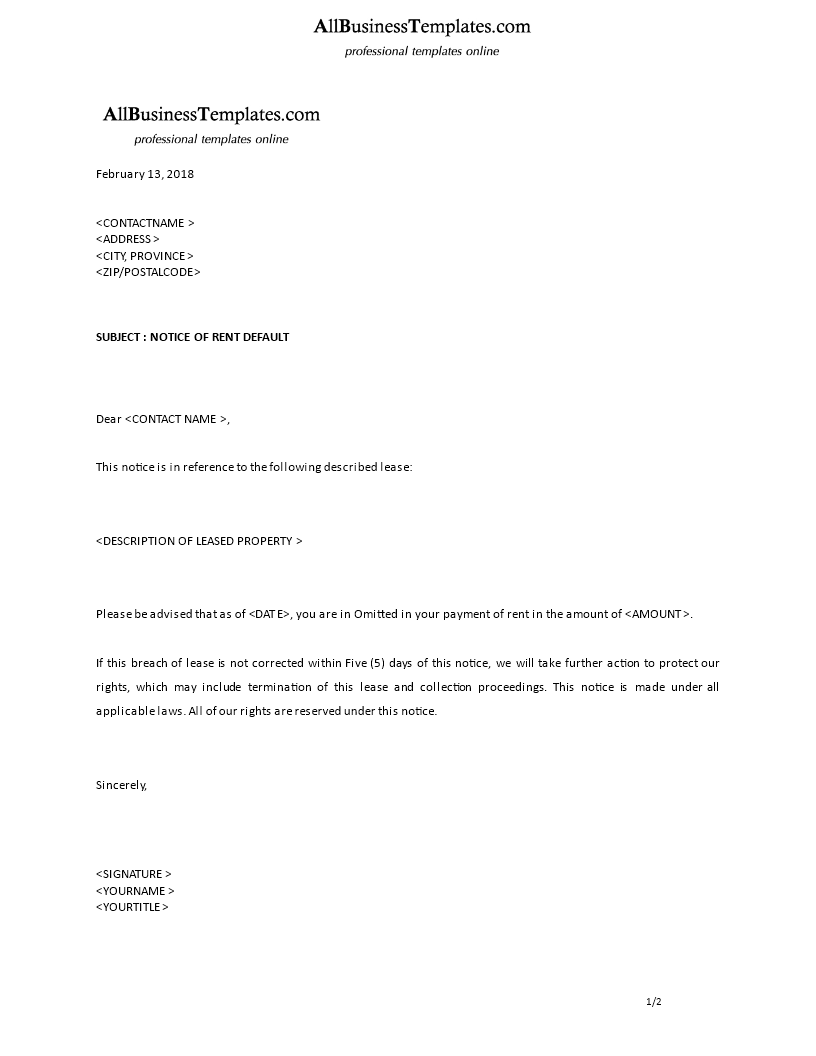

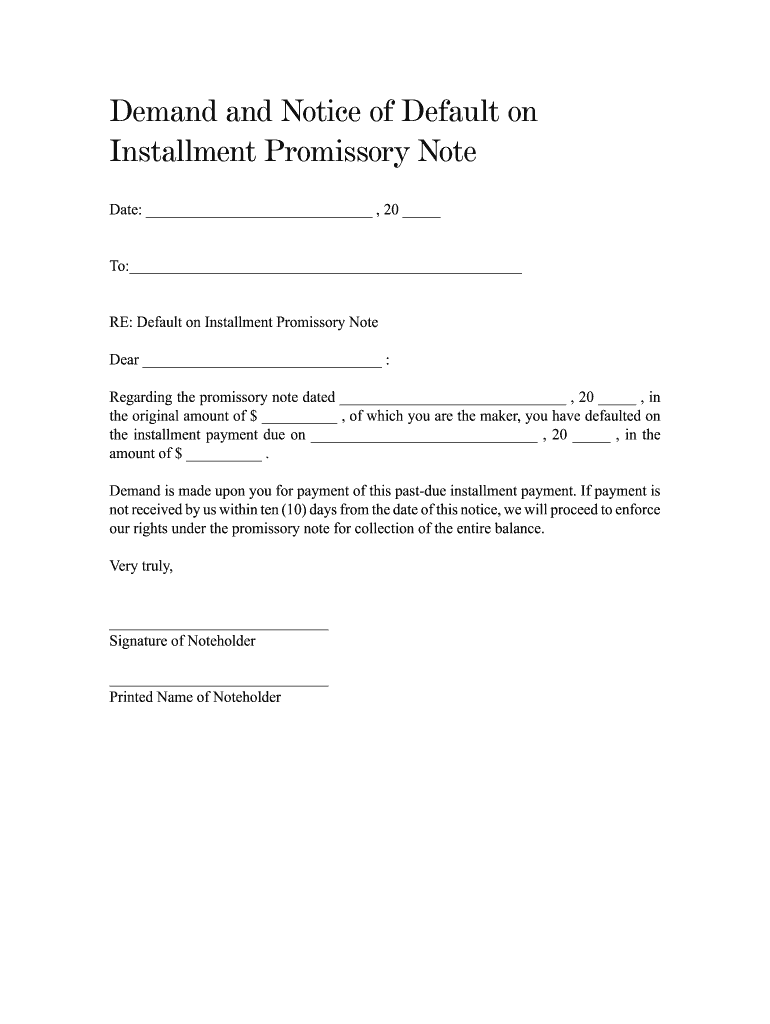

They typically send the default notice when you have not been paying (in full or in part) for three to six months. What is a default notice?Ī Notice of Default letter is a warning from a creditor that you have missed payments on your credit agreement.

We work with The Debt Advice Service who provide information about your options. This isn’t a full fact find, MoneyNerd doesn’t give advice.

0 kommentar(er)

0 kommentar(er)